Samunnati has established strong risk assessment and mitigation mechanisms, which, aided by cutting edge technology, help build quality businesses that are sustainable and result in inclusive growth. For this FPO, crop insurance through the Pradhan Mantri Fasal Bhima Yojana (PMFBY) was used as a risk mitigation mechanism to sustain people’s interest in farming and make it a profitable source of livelihood for them.

Registered in 2014, the Ramnad-based FPO focuses on reducing risks in agriculture and creating increased opportunities for farmers to earn better livelihood and income. However, despite their best efforts, they weren’t seeing much success. If rainfall and weather were favourable, farmers got better productivity and income. Failing which, they were forced to migrate to nearby towns and cities to make a living. The problem becomes evident in the average rainfall data for the region over the last 50 years which shows that Ramnad had been regularly drought-hit through four out of five years.

In such a challenging situation, the FPO was finding it difficult to not only to assist farmers, but also keep their spirits up. It was in this environment that Samunnati organised a workshop there to understand the scenario and educate the farmers about the various options available to them, Pradhan Mantri Fasal Bhima Yojana (PMFBY) being one of them. PMFBY, which aims to provide financial support to farmers suffering from crop loss or damages arising out of unforeseen events, was well-received in most parts of the country. But it didn’t receive a favourable response in Ramnad during the launch in 2016 as the community there had seen previously-launched crop insurance schemes being ineffective due to challenges in implementation and claim settlements.

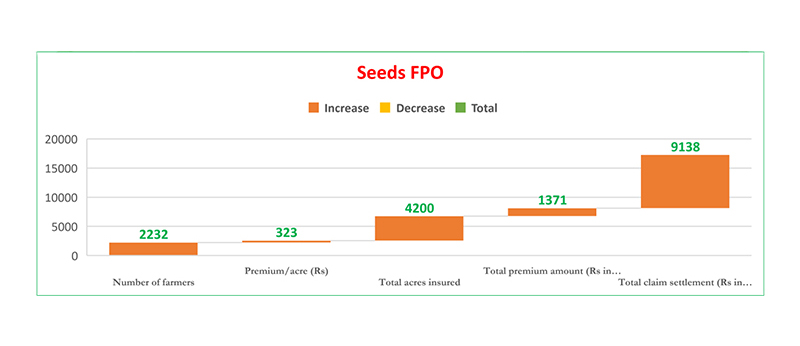

However, Samunnati and FPO persisted with their efforts, and after repeated interactions among its shareholders and board of directors, 2232 farmers decided to sign up for crop insurance for 4200 acres of land, paying INR 332 as the premium/acre. The FPO guided them through the steps of the registration – filling up applications, mobilizing documents and submitting them online. With Samunnati’s financial assistance agri inputs were made easily accessible to them.

When in 2016, Ramanathapuram didn’t receive enough rains, PMFBY released 100% claim amount for all the farmers in FPO, resulting in them getting INR 9.13 crores as claim settlement. For the first time in over half a century, the people of this land could breathe easy even in the time of drought.

These claim settlements not only enhanced the confidence of shareholders in PMFBY, but also motivated other disadvantaged farmers to join the scheme. As a result, 4100 farmers joined the company as new shareholders and opted for PMFBY in 2017. When rains didn’t support farmers’ Kharif crops in 2017, a claim settlements worth INR 33.30 crores was released directly to farmers’ accounts.

| PMFBY | 2016-17 | 2017-18 |

|---|---|---|

| Number of farmers | 2,232 | 6,324 |

| Premium/acre | 323 | 332 |

| Total acres insured | 4200 | 15,071 |

| Total premium amount | Rs. 13,70,670 | Rs. 49,96,414 |

| Total claim settlement | Rs. 9,13,77,993 | Rs. 33,30,94,279 (sanctioned) |

| Insurance company | AIC of India | AIC of India |

| Agreement with | Kali kadamadai | Infina ensure |

| Number of farmers who got settlement | 100 %. direct credit to farmers bank accounts | To be released directly to farmers bank account. |