People, Planet, Progress

At Samunnati, sustainability is not a pillar it’s the platform. From climate-resilient finance to inclusive agri-value chains, we embed purpose in every process. Our goal is to ensure that capital reaches where it creates the most lasting impact for people, the planet, and progress that truly sustains.

Milestone

Over ₹800 Cr in green and gender-focused credit deployed across 22 states, powered by instruments like green and orange bonds to scale climate-resilient agriculture.

Capital for Climate

Credit for Change

We embed sustainability at the core of our lending, focusing on climate‑smart and gender‑inclusive portfolios that drive both resilience and equity.

One fifth of Samunnati’s lending portfolio is aligned with Climate-Smart Agriculture.

Prioritizing Climate-Smart & Gender-Focused Lending

Unlocking Access to Thematic Capital

Transparent ESG Metrics and Reporting Mechanisms

Governed by Purpose

Driven by Principles

Our internal compass is set by a strong ESG governance framework that translates sustainability from a value to a daily operational standard.

Raised ₹1.25 Bn through Orange Bonds — advancing gender equality in financial systems.

ESG Governance spanning strategy, risk, and compliance

Transparent ESG Metrics and Reporting Mechanisms

Long-Term ESG Strategy guiding our operational ethos

From Field to

Future - Sustainably

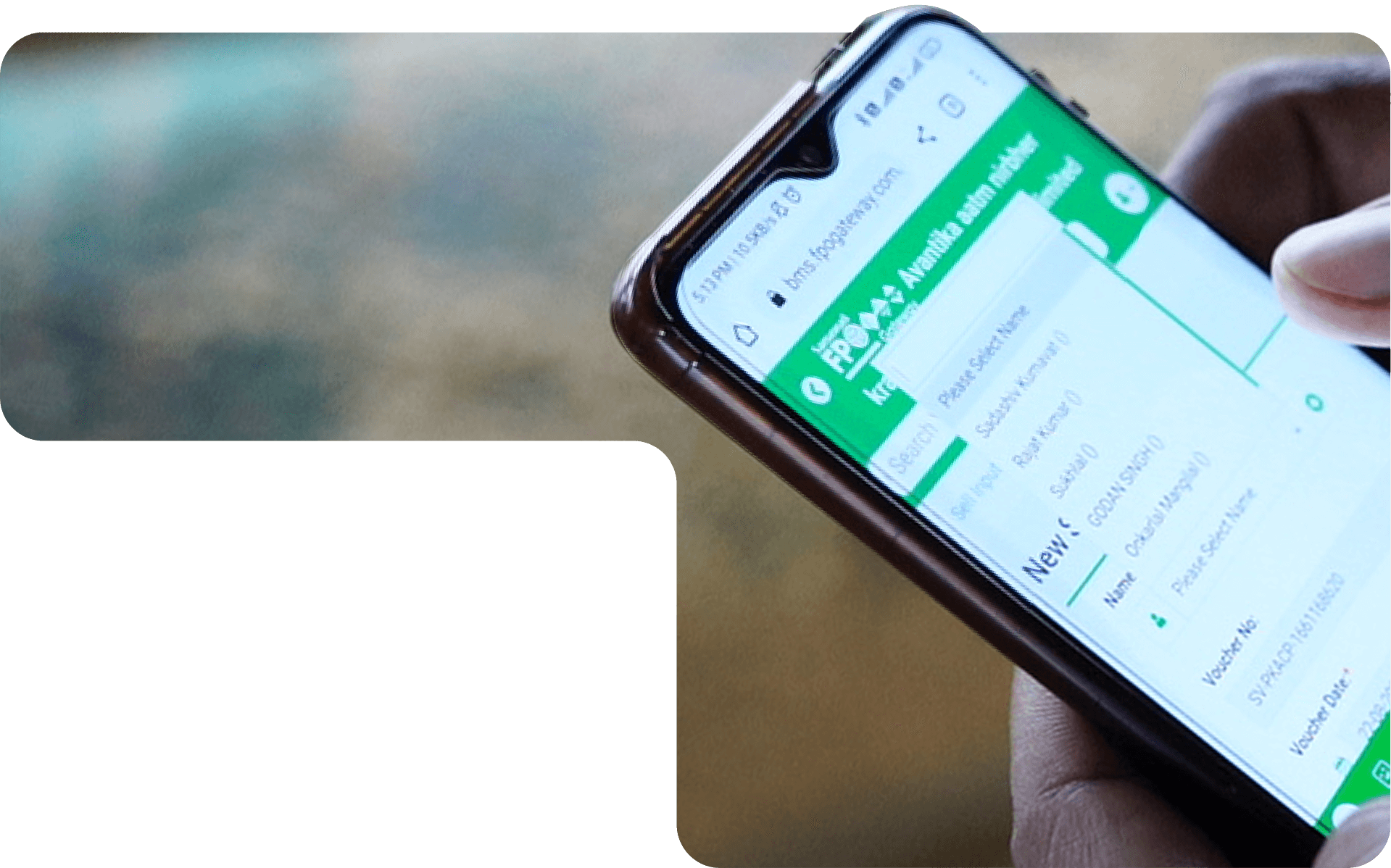

We are reimagining agriculture by strengthening sustainable practices across the value chain and enabling FPOs to lead the way.

₹2.1 Bn raised via Green Bonds for investments in green agri-assets.

Promoting Sustainable Agricultural Practices across regions

Capacity Building for FPOs through grassroots projects

Policy Partnerships for enabling environment and systemic impact

Where Impact Grows

and Equity Flows

Every intervention we make — from loans to logistics — is designed to enhance climate resilience, gender participation, and financial inclusion at scale.

SUSTAINABILITY REPORTAdvancing Climate-Resilient Agriculture

Empowering Women in Agri Value Chains

Expanding Access to Affordable Finance

First Agri-NBFC to issue India’s Listed Green Bond of ₹500 Mn.