Featured in Livemint

The initiative will introduce and support clean technologies for small-holder farmers, particularly women, that improve market linkages and increase incomes while having a positive impact on the environment.

MUMBAI : The US International Development Finance Corporation (DFC) and the United States Agency for International Development (USAID) on Friday said they are jointly sponsoring a $55 million ( ₹400 crore) credit guarantee to address the economic impact of covid-19 by supporting loans to farmer producer organizations, ag-tech companies, and companies engaged in clean energy solutions for the agriculture sector.

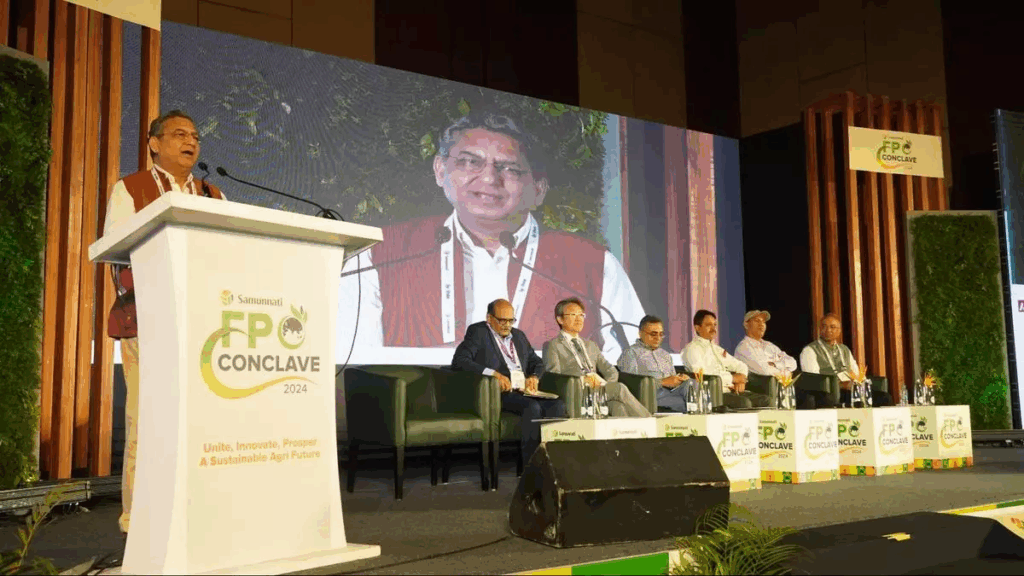

The initiative will introduce and support clean technologies for small-holder farmers, particularly women, that improve market linkages and increase incomes while having a positive impact on the environment. The financial support will be complemented with technical assistance led by the Rabo Foundation to focus on areas of business management and help in building stronger linkages to the markets. Loans to farmer producer organizations will be provided by three Indian lenders—Samunnati Financial, Maanaveeya, and Avanti Finance, a statement said.

“At USAID, we believe that providing farmers with access to cleaner, more affordable technology can improve the livelihood and climate resilience of the community. In addition, clean technologies offer a sustainable alternative to meeting agricultural demand, address food insecurity and improve nutritional outcomes. This support will address the health and economic needs of vulnerable farmer communities severely impacted by the covid-19 pandemic,” said Warren Harrity, director (program support) at USAID India.

Pim Mol, chief executive, Rabo Foundation said that only by joining forces and creating valuable partnerships, can small-holder farmers be provided the space and opportunities they need to improve their livelihoods and adapt to the challenges of climate change.

“We strongly believe that aggregation can solve multiple problems faced by small-holder farmers and this initiative can go a long way towards scaling the collectives through encouraging participation by mainstream capital providers,” said Manish Thakkar, chief operating officer at Avanti Finance.