Featured in BusinessLine

Samunnati expects lending to double over the next 2 years

Agri value chain financier Samunnati expects its lending to climate-smart compliant agriculture assets to more than double over the next two years on rising awareness for mitigating climate change.

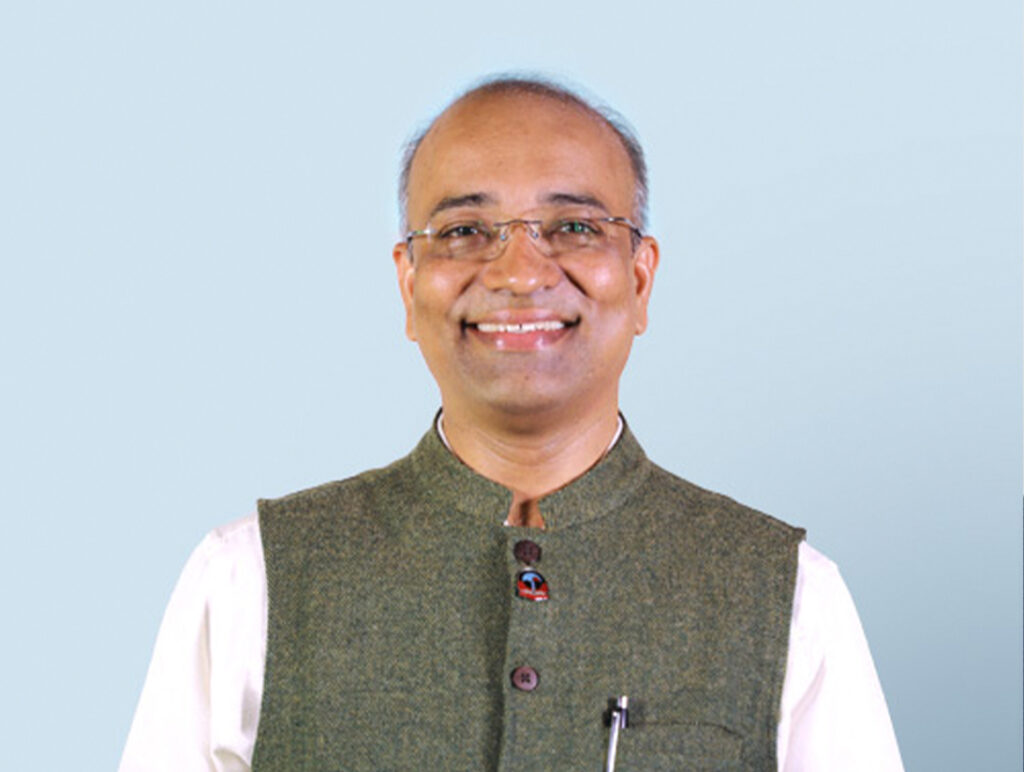

Anil Kumar SG, Founder and CEO, Samunnati said the company’s lending to such assets is seeing more traction.

“We could be about 25 per cent of the total lending over the next two years from the 10-12 per cent now and it will only increase,” he said.

Out of its total lending of ₹8,624 crore, so far, Samunnati has done climate-smart asset funding of around ₹1,000 crore, Anil Kumar said. It has set up an eight-member team to focus on the climate-smart agri segment.

Varied activities

Of the 270-odd identified categories, Samunnati’s climate-smart asset compliant value chain activities include lending to initiatives on soil nutrient improvement (organic input and output), water conservation (precision farming, agroforestry, hydroponics, micro-irrigation), wastage reduction in food processing, cold storage, reduced emission (solar equipment, sustainable dairy, bio-fuel and bio-mass) reduced chemicals (precision farming, organic input and hydroponics), among others.

Samunnati also has exposure to millet-based activities, afforestation activities — crops that increase the green cover and are also working with the plantation sector that helps preserve it, he said.

Samunnati, which has witnessed good growth in the credit disbursals in the agri sector, is looking to raise a fresh round of equity.

“We have a run-rate of around ₹400 crore per month and as part of our growth plans, we are launching the process for next fundraise,” Anil Kumar said.

The company has given the fund-raising mandate to Kotak and Cantor Fitzgerald. “We are looking at raising around $100 million in the Series E funding,” he said. So far, the company has raised ₹590 crore in equity.