Featured in Hindu Businessline

Virudhunagar pilot to pave way for nation-wide rollout Farmers in Tamil Nadu, and their peers in other States, are about to soon taste the benefits of blockchain, artificial intelligence and machine learning solutions.

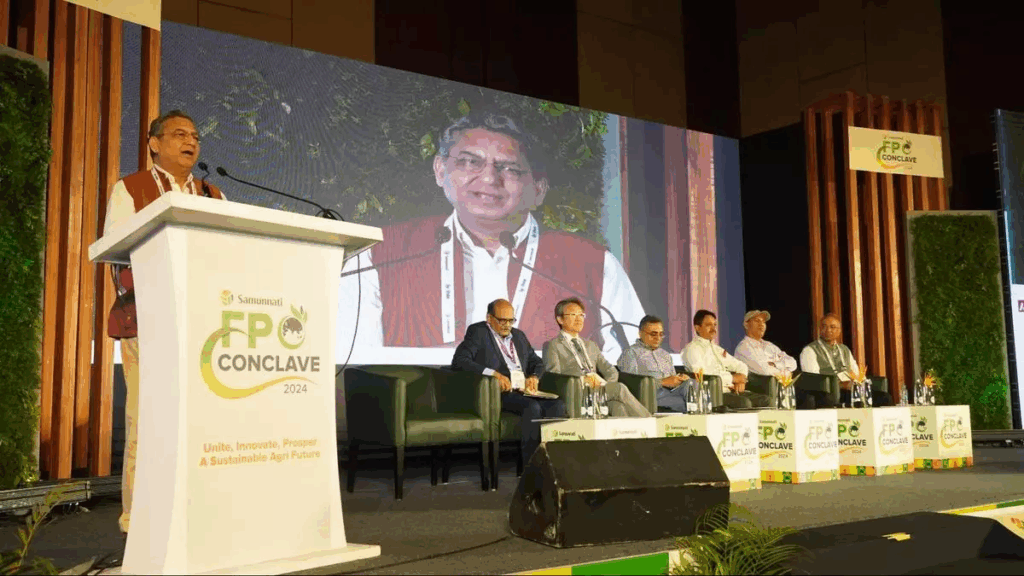

Samunnati, a Chennai-based organisation which works with Farmer Producer Organisations (FPOs) and other players in the agri ecosystem, has joined hands with the University of Hyderabad to introduce these deep technologies that promise to reduce operational inefficiencies. For one, it ensures proper use of credit. “If a token is issued to purchase seeds or fertilisers, the system will ensure that it is used for that purpose only and not for something else,” Sridhar Easwaran, Founding Member and Senior Vice-President (Institution and Capacity Building) of Samunnati, told BusinessLine.

Developed by the University of Hyderabad (UoH) in association with a few partners, the integrated agri blockchain can record every step in a product’s value chain.“The blockchain platform can connect farmers with all the stakeholders in the ecosystem – right from vendors, food processors to packaging firms,” Vijaya Bhaskar, Professor of Finance and Fintech at the UoH, has said. “It will allow buyers and sellers to converse in a secure and trusted environment, eliminating the need for an intermediary,” he said. Sridhar said Samunnati will help FPOs to deploy the technology solution, onboarding their member-farmers onto the platform.

Pilot project

The platform would give a complete visibility of the number of farmers, their credit and input needs. “This would mean a lot for the people on the demand side (like bulk buyers) and financial institutions,” he said. In the pilot launched on August 15 in Virudhunagar District of Tamil Nadu, several FPOs under the aegis of Social Education Economical Development Society (SEEDS) joined the blockchain platform. Samunnati will introduce the technology to other States where it has operations. “Our next stop will be in Kamareddy district (Telangana),” he said.

He said the platform would help in traceability, generating accurate data on farmers’ input requirements. It is estimated that there would be potential cost savings of about 70 per cent on central finance reporting and 30-50 per cent savings on compliance.

For farmers, it would mean better access to credit and additional value generation as it helps in reducing inefficiencies in the value chain